Table of Contents

ToggleA Brief History of SMFG

Sumitomo Mitsui Financial Group, Inc. (SMFG) is a financial services company based in Japan. The group was formed in 2001 through the merger of Sumitomo Mitsui Banking Corporation (SMBC) and Sakura Bank, under the leadership of Masayuki Oku as the first chairman.

SMBC, one of the constituent banks of SMFG, has a history dating back to 1876 when it was established as The Bank of Tokyo. Throughout the years, it expanded its operations and services, becoming one of the leading financial institutions in Japan.

Sakura Bank, on the other hand, was founded in 1873 as Yokohama Specie Bank. It went through various mergers and name changes before merging with SMBC to form SMFG.

After the merger, SMFG further expanded its reach and influence in the global financial market. It has continued to grow and diversify its services, including banking, securities, and asset management.

Today, Sumitomo Mitsui Financial Group, Inc. is one of the largest financial institutions in Japan and plays a significant role in the country’s economy. It operates globally, with a strong presence in Asia, the Americas, and Europe, serving a wide range of clients and businesses.

Who Owns SMFG?

Sumitomo Mitsui Financial Group, Inc. is owned by a combination of institutional and individual investors. The largest shareholders of the company are other financial institutions, as well as individuals and mutual funds. As of the latest available information, the top 10 shareholders of Sumitomo Mitsui Financial Group, Inc. include Mizuho Financial Group, The Vanguard Group, Inc., BlackRock, Inc., State Street Corporation, Norges Bank Investment Management, Mitsubishi UFJ Financial Group, Inc., and others. These shareholders hold significant stakes in the company and play a crucial role in its overall ownership and governance.

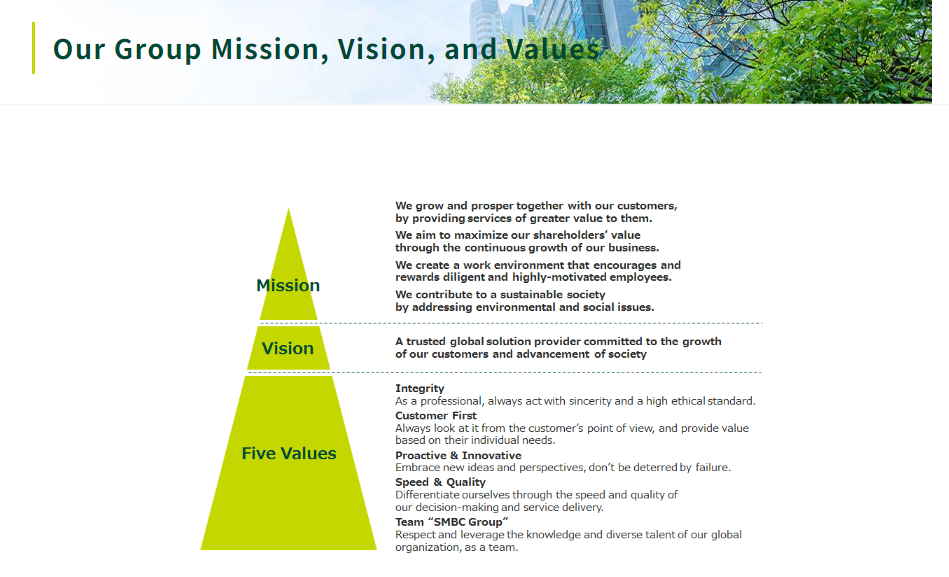

SMFG Mission Statement

Sumitomo Mitsui Financial Group, Inc. (SMFG) mission statement is to contribute to the sound development of Japan and the global economy by providing a wide range of financial services. They strive to create value for their customers, shareholders, and society as a whole through their commitment to innovation and sustainable growth. SMFG aims to be a trusted partner for their clients and a responsible corporate citizen, adhering to the highest standards of integrity and ethics in all of their business practices.

How SMFG Makes Money?

Sumitomo Mitsui Financial Group, Inc. (SMFG) is a financial services company that operates through its banking, securities, and other financial services segments. The company makes money primarily through interest income, fees, and commissions, and gains from financial instruments. SMFG generates its revenue from a wide range of financial products and services including lending, deposits, asset management, underwriting, and trading. Additionally, the company also earns income through its investment in other businesses and strategic partnerships. Overall, SMFG’s diversified revenue stream and strong presence in the global financial market contribute to its strong financial performance.

SMFG Business Model Canvas

The Business Model Canvas is a strategic management tool that helps businesses to visualize, analyze, and design their business model. It consists of 9 key components including customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partners, and cost structure. In this analysis, we will create a detailed Business Model Canvas for Sumitomo Mitsui Financial Group, Inc. which is a leading financial services group based in Japan.

Customer Segments:

1. Individuals – retail banking services

2. Small and medium-sized businesses – business banking services

3. Corporations – corporate banking and investment banking services

4. Institutions – institutional and wholesale banking services

5. Investors – asset management and brokerage services

Value Propositions:

1. Diversified financial services

2. Strong risk management

3. Innovative banking solutions

4. Global network and capabilities

5. Personalized customer service

Channels:

1. Physical branches

2. Online and mobile banking platforms

3. ATM network

4. Relationship managers and financial advisors

5. Strategic partnerships with other financial institutions

Customer Relationships:

1. Personalized customer service

2. Relationship managers

3. Digital banking platforms

4. Financial advisory services

5. Customer loyalty programs

Revenue Streams:

1. Interest income from lending and deposits

2. Fee-based income from investment, brokerage, and wealth management services

3. Commissions from insurance and other financial products

4. Asset management fees

5. Transaction fees and foreign exchange income

Key Resources:

1. Financial products and services

2. Human capital and talent

3. Technology and digital infrastructure

4. Capital and liquidity

5. Brand reputation and customer trust

Key Activities:

1. Lending and credit activities

2. Investment banking and capital market activities

3. Asset management and wealth advisory

4. Risk management and compliance

5. Innovation and technology development

Key Partners:

1. Other financial institutions

2. Technology partners

3. Regulatory authorities

4. Insurance providers

5. Corporate and institutional clients

Cost Structure:

1. Employee salaries and benefits

2. Technology and infrastructure expenses

3. Marketing and customer acquisition costs

4. Regulatory and compliance costs

5. Administrative and operational expenses

Sumitomo Mitsui Financial’s Competitors

Sumitomo Mitsui Financial Group, Inc. is a leading financial services company based in Japan. The company’s main competitors include other global banking and financial services firms. Some of the top competitors of Sumitomo Mitsui Financial Group, Inc. include Mitsubishi UFJ Financial Group, Mizuho Financial Group, Nomura Holdings, Daiwa Securities Group, and Shinsei Bank. These companies also operate in the Japanese and international markets, offering a range of financial products and services, and are key players in the global financial industry.

Sumitomo Mitsui Financial SWOT Analysis

Strengths:

1. Strong global presence with operations in over 40 countries.

2. Diverse range of financial services offered, including banking, securities, and asset management.

3. Strong financial performance and profitability.

4. Robust risk management and compliance framework.

Weaknesses:

1. Dependency on the Japanese market for a significant portion of revenue.

2. Limited presence in some key international markets.

3. Vulnerability to economic and regulatory changes in the financial sector.

Opportunities:

1. Expansion into emerging markets to diversify revenue streams.

2. Growing demand for digital banking and fintech solutions.

3. Potential for strategic partnerships or acquisitions to expand market presence.

Threats:

1. Intense competition in the global financial services industry.

2. Regulatory changes and compliance requirements impacting business operations.

3. Economic downturns and market volatility affect financial performance.

Concluding Analysis

In conclusion, Sumitomo Mitsui Financial Group, Inc. has demonstrated a robust and resilient business model that has positioned them as a leading financial institution globally. With a strong focus on customer-centric services and innovative financial products, the company has shown impressive growth and profitability over the years. As an analyst, my perspective on the future of the business is quite optimistic. With their strategic alliances and prudent risk management practices, I believe that Sumitomo Mitsui Financial Group will continue to thrive in the ever-evolving financial landscape. The company’s commitment to technological advancements and sustainable business practices also bodes well for its long-term success. Overall, Sumitomo Mitsui Financial Group, Inc. is well poised to continue its success and maintain its position as a leader in the financial industry.

Additional Resources

To keep learning and advancing your career, we highly recommend these additional resources:

Business Model Canvas of The Top 1,000 Largest Companies by Market Cap in 2024

A List of 1000 Venture Capital Firms & Investors with LinkedIn Profiles

Peter Thiel and the 16 Unicorns: The Legacy of Thiel Fellowship