Table of Contents

ToggleA Brief History of RELX

RELX PLC is a multinational information and analytics company based in London, UK. The company was originally formed as Reed Elsevier in 1993 through the merger of Reed International and Elsevier.

Reed International had its origins in the mid-20th century as a newsprint and publishing business, while Elsevier was founded in the 19th century as a publishing company specializing in scientific and medical literature.

After the merger, RELX PLC continued to grow and expand its business, focusing on providing information and analytics to various industries, including science, legal, and risk management. The company also made several strategic acquisitions to enhance its product and service offerings.

In recent years, RELX PLC has further diversified its business through acquisitions and joint ventures, expanding its presence in the global market. Today, RELX PLC is a leading provider of information and analytics and operates in over 40 countries, serving customers in more than 180 countries.

Who Owns RELX?

RELX PLC, a global provider of information-based analytics and decision tools, is owned by its shareholders. The company’s ownership is distributed among a diverse group of institutional and individual investors who hold shares of the company. The top 10 shareholders of RELX PLC as of the present time are as follows:

1. BlackRock, Inc.

2. The Vanguard Group, Inc.

3. Legal & General Group Plc

4. Norges Bank Investment Management

5. Capital Research & Management Co.

6. Massachusetts Financial Services Co.

7. State Street Corporation

8. Invesco Ltd.

9. T. Rowe Price Associates, Inc.

10. Capital Group Companies, Inc.

These shareholders represent a mix of investment firms and institutional investors who have a stake in the success and performance of RELX PLC.

RELX Mission Statement

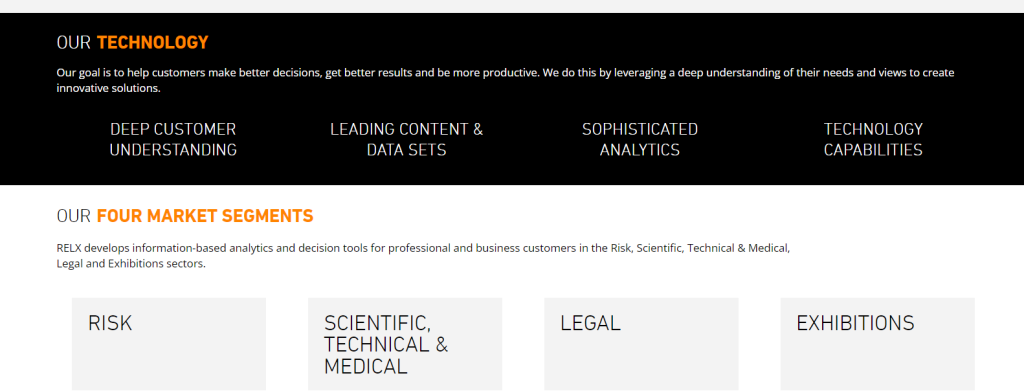

RELX PLC’s mission is to provide information and analytics to help customers make better decisions and achieve their objectives. The company is committed to creating innovative products and solutions that enable users to access and interpret data more effectively, ultimately leading to improved outcomes for businesses, governments, and individuals. RELX PLC is dedicated to maintaining the highest ethical standards and promoting a culture of diversity and inclusion in order to foster a dynamic and forward-thinking environment.

How RELX Makes Money?

RELX PLC operates as a global provider of information and analytics for professional and business customers. The company generates revenue through its subscription-based products and services, as well as through the sale of content, data, and analytics to its customers. RELX PLC offers a diverse range of products and services across various industries, including scientific, legal, and risk management. The company’s business model is centered around providing high-value information and insights to its customers, helping them make better-informed decisions and ultimately driving revenue for RELX PLC.

RELX Business Model Canvas

The Business Model Canvas (BMC) is a strategic management tool that allows businesses to visually map out key elements of their business model. It provides a clear overview of the company’s strategy and helps identify potential areas for improvement. The BMC consists of nine subheadings: Customer Segments, Value Propositions, Channels, Customer Relationships, Revenue Streams, Key Resources, Key Activities, Key Partners, and Cost Structure.

1. Customer Segments

– RELX PLC’s customer segments include academic and research institutions, libraries, healthcare professionals, legal professionals, and corporate and government organizations.

– The company targets customers who require access to scientific, technical, and medical information, legal and regulatory solutions, and other professional content.

2. Value Propositions

– RELX PLC offers valuable solutions in the form of digital and print resources, data analytics, decision tools, and expert services.

– The company provides reliable and secure access to high-quality information and helps customers make informed decisions.

3. Channels

– RELX PLC distributes its products and services through direct sales, online platforms, third-party vendors, and partner networks.

– The company leverages its digital infrastructure to deliver content and solutions to customers worldwide.

4. Customer Relationships

– RELX PLC maintains customer relationships through personalized interactions, customer support, and ongoing engagement.

– The company provides access to customer portals, training resources, and industry events to enhance customer experience.

5. Revenue Streams

– RELX PLC generates revenue through subscription-based models, pay-per-view access, licensing agreements, and professional services.

– The company also offers customized solutions and add-on products to drive additional revenue streams.

6. Key Resources

– RELX PLC’s key resources include proprietary content databases, advanced technology platforms, global network infrastructure, and a talented workforce.

– The company invests in research and development, content acquisition, and data security to maintain its competitive edge.

7. Key Activities

– RELX PLC’s key activities encompass content creation, product development, sales and marketing, data analysis, and customer support.

– The company continuously enhances its products and services to meet the evolving needs of its customers.

8. Key Partners

– RELX PLC collaborates with academic publishers, industry associations, technology providers, and research institutions to expand its content offerings and market reach.

– The company also forms strategic alliances with distribution partners and resellers to extend its global footprint.

9. Cost Structure

– RELX PLC incurs costs related to content licensing, technology infrastructure, marketing and sales, research and development, and talent acquisition.

– The company manages its cost structure through efficiency measures, strategic investments, and operational optimization.

RELX PLC’s Competitors

RELX PLC faces competition from other major players in the information and analytics industry. The top 5 competitors of RELX PLC are Thomson Reuters, Wolters Kluwer, Informa, Pearson, and John Wiley & Sons. These companies are also global leaders in providing professional information, software solutions, and educational materials to various industries and sectors. They continue to innovate and expand their offerings, posing a competitive challenge to RELX PLC in the market.

RELX SWOT Analysis

Strengths:

1. Strong and diversified product portfolio

2. Global presence and market leadership

3. Innovation and investment in R&D

4. Strong financial performance

5. Strong brand recognition and reputation

Weaknesses:

1. Dependence on the regulatory environment

2. Vulnerability to economic downturns

3. Limited presence in certain regions

4. Reliance on third-party suppliers

Opportunities:

1. Expansion into emerging markets

2. Growth in e-cigarette and heated tobacco markets

3. Technological advancements in vaping products

4. Increased demand for reduced-risk products

5. Strategic acquisitions and partnerships

Threats:

1. Increasing regulations and restrictions

2. Intense competition from traditional tobacco companies and new players

3. Health concerns and negative public perception of vaping

4. Fluctuating currency exchange rates

5. Legal and litigation risks from claims related to products.

Concluding Analysis

So, in summary, the business model of RELX PLC is built on a strong foundation of providing information and analytics to a wide range of industries and professionals. With a focus on digital transformation and expanding into new markets, the company has shown resilience and adaptability in the face of industry changes. As an analyst, I am optimistic about the future of RELX PLC. The company’s strategic investments and focus on innovation position it well for continued growth and success in the ever-evolving business landscape. I believe that with its strong business model and adaptability, RELX PLC will continue to thrive and remain a leader in its industry for years to come.

Additional Resources

To keep learning and advancing your career, we highly recommend these additional resources:

Business Model Canvas of The Top 1,000 Largest Companies by Market Cap in 2024

A List of 1000 Venture Capital Firms & Investors with LinkedIn Profiles

Peter Thiel and the 16 Unicorns: The Legacy of Thiel Fellowship