As we embark on this enlightening journey, we delve deep into the essence of Business Model Innovation, guided by the transformative principles of Odyssey 3.14. In this article, we dissect the three fundamental components of a business model, unraveling its intricate layers and unveiling its strategic significance.

Table of Contents

ToggleOrigins of the Business Model Concept

The term “business model” traces its origins back to the information technology sector of the 1970s. However, its widespread adoption burgeoned with the advent of e-business towards the late 1990s. As the internet revolutionised commerce, start-ups sought to explain their profit-generation strategies to investors, giving rise to the ubiquitous use of the term “business model”. Despite its initial association with the dot-com bubble, the concept has evolved into a cornerstone of strategic thinking, transcending industry boundaries.

What’s a Business Model, Anyway?

Simply put, a business model is a plan that shows how a company makes money. It’s like a roadmap for success, showing what the company offers, who it sells to, and how much it charges. There are 2 popular business model frameworks.

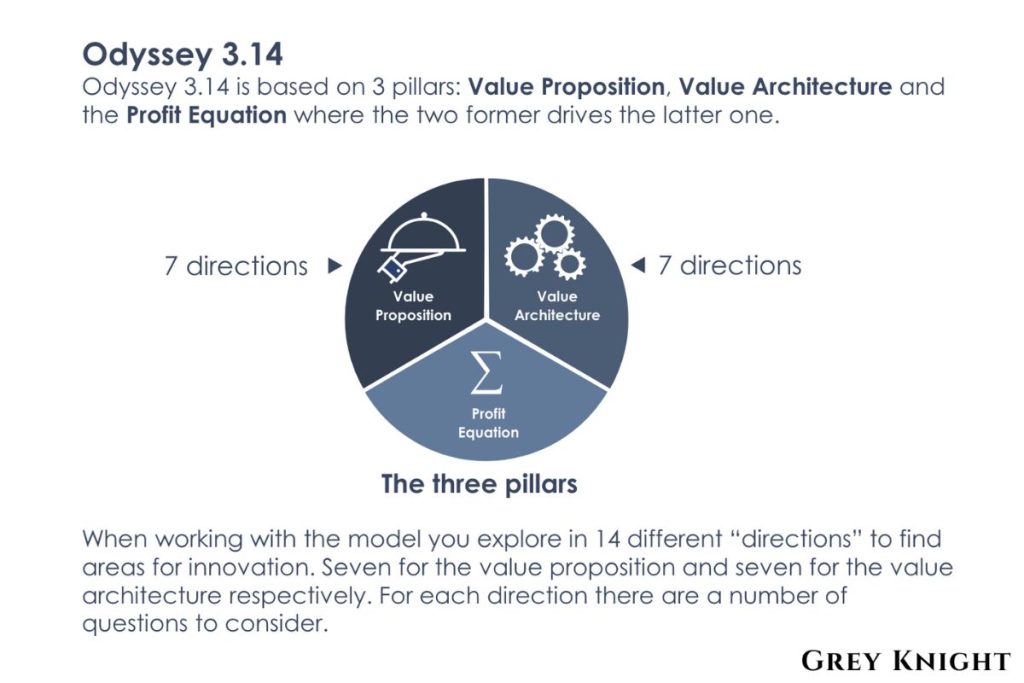

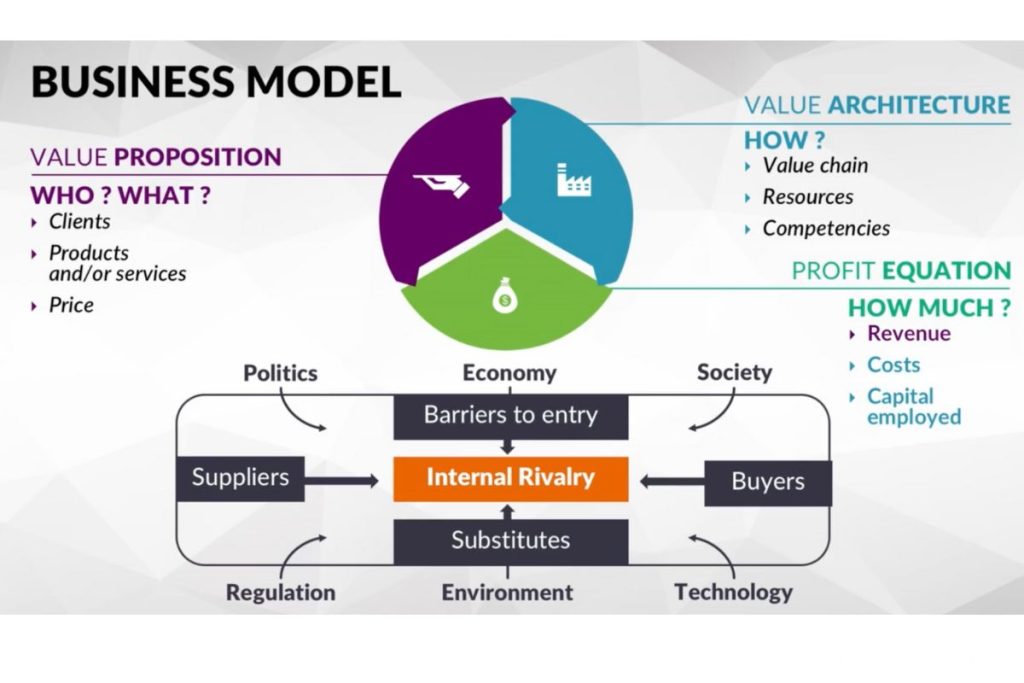

The Odyssey 3.14 defines the business model around our three pillars: the value proposition, the value architecture and the profit equation.

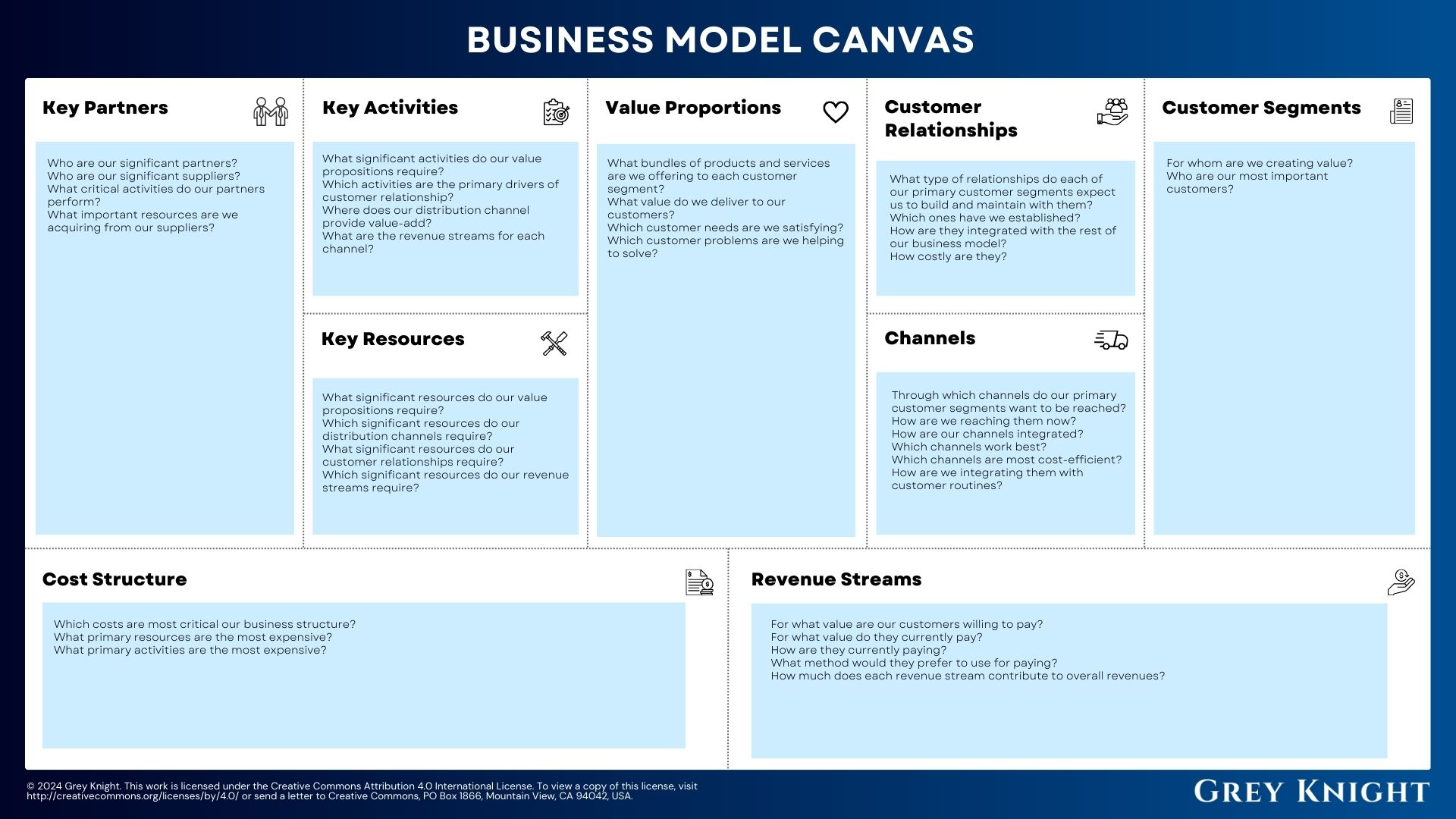

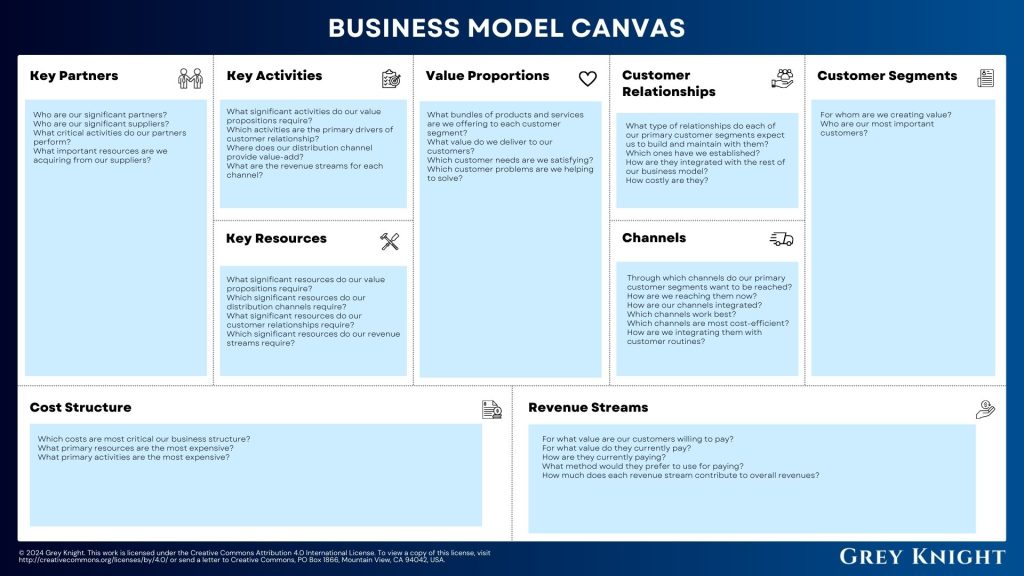

Business Model Canvas comes from this bestselling book: Business Model Generation, by Alexander Osterwalder, a Swiss business theorist and consultant. In this book, Osterwalder uses nine components for his business model framework.

The Odyssey 3.14

This approach has been pitched by Dr. Laurence Lehmann-Ortega and Helene Musikas after over 10 years of research, consulting and teaching at HEC Paris Business School. I learned about this framework from a course offered by HEC Paris on Coursera, taught by Laurence and Helene.

If you’re wondering why it’s named Odyssey 3.14? The 3.14 suggests three main components (Value Proposition, Value Architecture & Profit Equation) for coming up with innovative business models. Along with that, it gives us 14 different directioins to explore innovation business models.

In this post, we’re going to focus on the main components of the framework. They’re called the Value Proposition, the Value Architecture, and the Profit Equation.

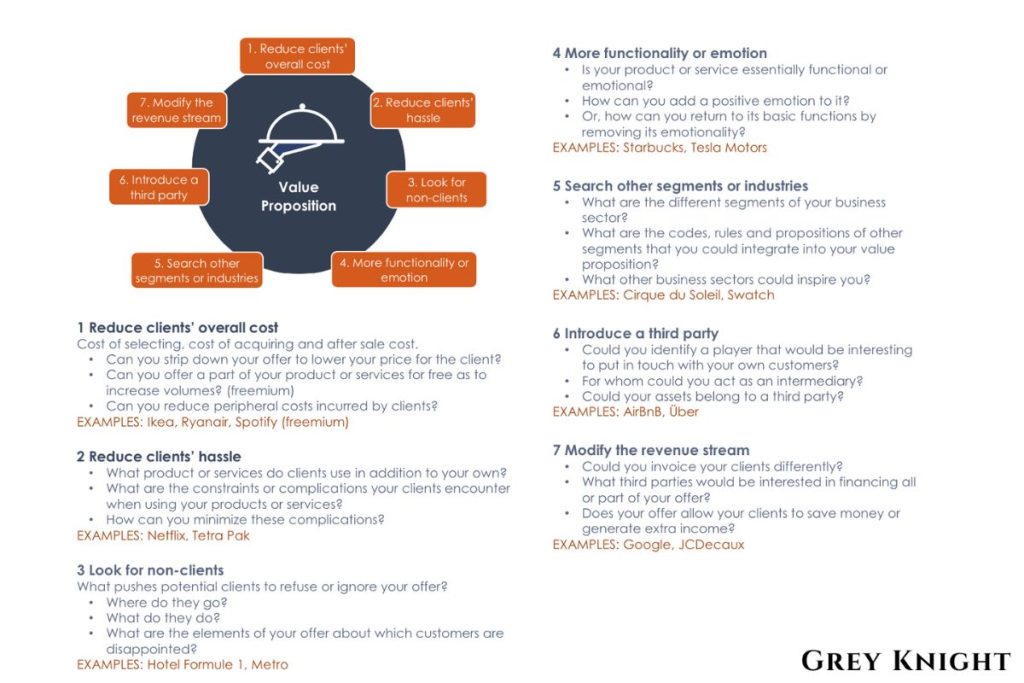

The Value Proposition

At the heart of every business model lies the value proposition, the essence of what the company offers, to whom, and at what price. This foundational pillar is all about what the company offers its customers and how much it charges. It’s like saying, “Here’s what we’ve got, and here’s how much it costs.”

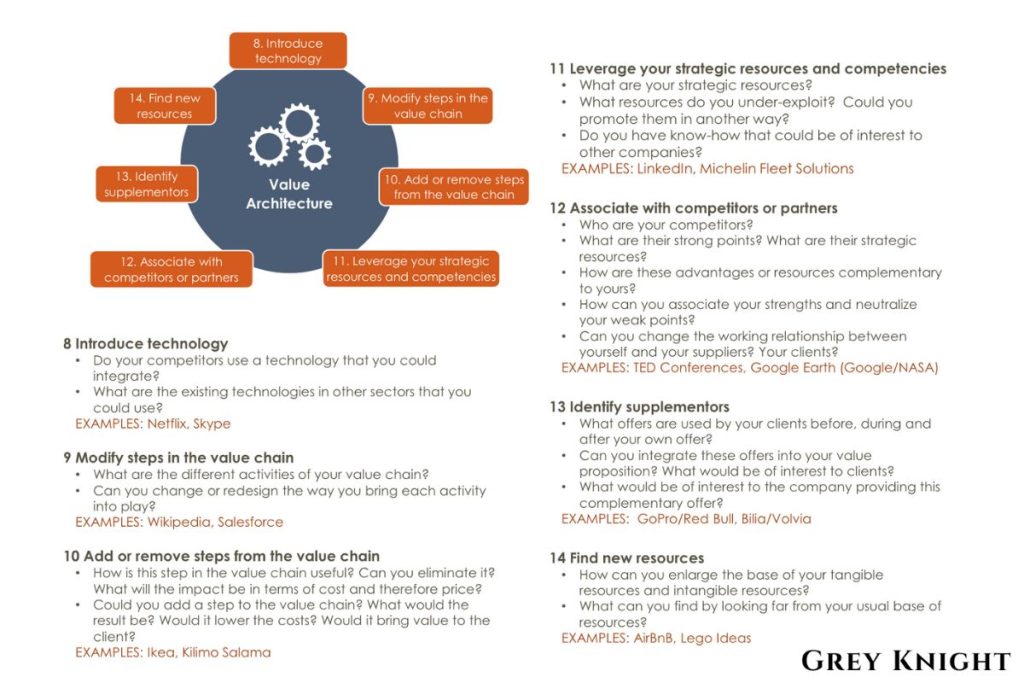

The Value Architecture

Building upon the value proposition, the value architecture describes the mechanisms through which the company creates and delivers value to its clientele. It shows how the company creates and delivers what it offers. It’s like explaining how the company works behind the scenes to make sure customers get what they paid for.

The Profit Equation

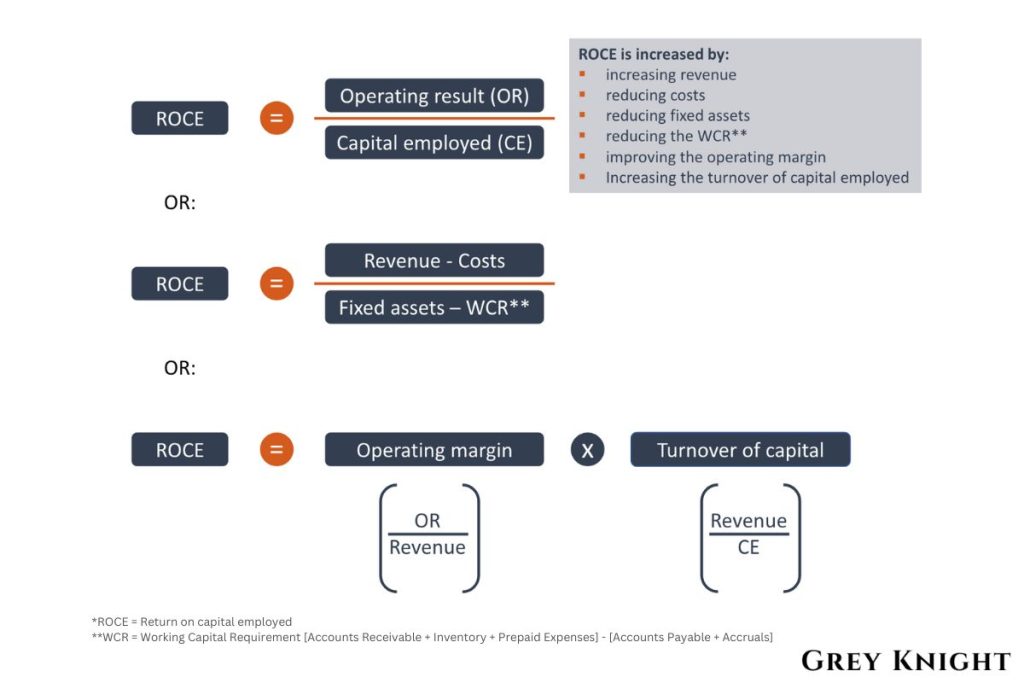

The profit equation explains the financial underpinnings of the preceding pillars. By aligning revenue generation with cost structures and capital utilisation, organisations can chart a course towards sustainable profitability and long-term growth. It’s about balancing how much money comes in from sales with how much it costs to run the business. If the company can make more money than it spends, it’s a win!

Putting It All Together

Success in business comes from aligning what you offer with how you deliver it. It’s not just about being cheap, it’s about being smart with your resources to make a profit. By understanding and balancing these three parts of the business model, companies can set themselves up for success in the long run.

Business Model Canvas

Customer Segments

Identifying the different groups of customers or markets that a business serves or targets.

Value Proposition

Describing the products or services that address the needs and wants of the customer segments and differentiate the business from its competitors.

Channels

Outlining the channels or methods through which the business delivers its value proposition to customers and communicates with them.

Customer Relationships

Defining the types of relationships a business establishes and maintains with its customers to acquire, retain, and grow its customer base.

Revenue Streams

Identifying the sources of revenue or how the business earns money from each customer segment.

Key Resources

Listing the critical assets, resources, and capabilities required to deliver the value proposition and operate the business effectively.

Key Activities

Identifying the key tasks, operations, or activities that are necessary to create and deliver the value proposition.

Key Partnerships

Identifying the external entities, suppliers, or partners that contribute to the business’s value creation and help it operate more efficiently.

Cost Structure

Detailing the expenses, costs, and investments associated with operating the business, including fixed and variable costs, and how revenue is allocated.

Odyssey 3.14 & Business Model Canvas – A Comparative Analysis

Ease of Understanding

One notable difference between the two frameworks lies in their simplicity and ease of understanding. While both frameworks offer valuable insights, users often find Odyssey 3.14’s three-pillar structure easier to grasp initially. This streamlined approach provides a holistic overview of the business model, allowing users to delve into detailed components later.

Comparing Components

Upon closer examination, we notice significant overlap between the two frameworks. For instance, customer segments, customer relationships, and the value proposition in the Business Model Canvas align closely with the value proposition pillar in Odyssey 3.14. Similarly, key partners, key activities, key resources, and channels in the Business Model Canvas correspond to the value architecture pillar in Odyssey 3.14.

Harmony and Compatibility

Both frameworks emphasize the importance of coherence and harmony within the business model. Whether using Odyssey 3.14 or the Business Model Canvas, the goal remains the same: ensuring that all elements work together seamlessly to drive success.

Strategic Thinking and Innovation

In the realm of strategic thinking and innovation, business models play a pivotal role. By using frameworks like Odyssey 3.14 or the Business Model Canvas, organizations can navigate the complexities of innovation with clarity and purpose. These frameworks serve as invaluable tools for strategic planning, guiding businesses towards sustainable growth and profitability.

Addressing Key Differences

Despite their similarities, there are two key differences between Odyssey 3.14 and the Business Model Canvas. Firstly, Odyssey 3.14 offers a more concise view with three components compared to the nine components in the Business Model Canvas. This streamlined approach facilitates a holistic understanding of innovation. Secondly, Odyssey 3.14 considers capital employed, whereas the Business Model Canvas focuses solely on revenue and costs. This inclusion of capital employed underscores the importance of strategic thinking in resource management and long-term planning.

Business Model vs Strategy

Business models aren’t just about making money, they’re also about strategy. Think of strategy like a big puzzle. A business model is just one piece of that puzzle. It helps companies understand how they make money now and how they want to make money in the future.

Let’s start with looking at other companies in the same industry. Imagine the airline industry, for example. There are different types of airlines, like low-cost ones and traditional ones. Each has its own business model. Using business models helps us understand how these different airlines make money and stay profitable.

Now, let’s talk about strategy. Strategy is like a roadmap for the future. It’s not just about making money, it’s about how to grow and stay successful. Business models are a part of this strategy, but they’re not the whole picture. Strategy also looks at things like the company’s environment and the industry it’s in. Tools like the PESTEL framework and Porter’s 5 Forces help with this.

So, while business models are important for understanding how a company makes money, they’re just one piece of the puzzle. Strategy is much bigger, it’s about planning for the future and staying ahead of the competition. By using tools like business models alongside other strategic concepts, companies can set themselves up for success.

Conclusion

Understanding the relationship between business models and strategy is key to navigating the complex world of business. Remember, business models help us understand how companies make money, but strategy is about much more than that. It’s about planning for the future and staying ahead of the game. In our next discussion, we’ll dive deeper into the intricacies of business models. Stay tuned!

Additional Resources

To keep learning and advancing your career, we highly recommend these additional resources:

Business Model Canvas of The Top 1,000 Largest Companies by Market Cap in 2024

A List of 1000 Venture Capital Firms & Investors with LinkedIn Profiles

Peter Thiel and the 16 Unicorns: The Legacy of Thiel Fellowship