Table of Contents

ToggleA Brief History Lululemon

Lululemon was founded in 1998 by Chip Wilson in Vancouver, Canada. The company started as a retailer of yoga and athletic wear, with a focus on producing high-quality, stylish garments that were suitable for both yoga and other athletic activities.

Lululemon quickly gained popularity and received widespread acclaim for its innovative designs and commitment to sustainability. The brand’s dedication to promoting a healthy, active lifestyle and its emphasis on technical functionality set it apart from other athletic wear companies.

In 2007, Lululemon went public and its stock became listed on the Nasdaq stock exchange. The company continued to expand its product line to include a wider range of athletic apparel and accessories, and opened numerous retail locations across North America and internationally.

Despite facing some controversies and setbacks, including a recall of its popular yoga pants in 2013 due to sheerness issues, Lululemon has maintained its position as a leading activewear brand. The company has also embraced e-commerce and digital marketing to connect with consumers and expand its global reach.

In recent years, Lululemon has focused on diversifying its product offerings and expanding into new markets, including menswear, footwear, and accessories. The brand’s commitment to innovation and quality has solidified its position as a beloved and trusted name in the athletic wear industry.

Who Owns Lululemon?

Lululemon is primarily owned by institutional investors and mutual funds, with individual shareholders also holding a significant portion of the company’s stock. The top 10 shareholders of Lululemon Athletica Inc. as of the most recent data available include: 1) FMR LLC (Fidelity Investments) 2) The Vanguard Group Inc. 3) BlackRock Inc. 4) Capital Research & Management Co. 5) Canada Pension Plan Investment Board 6) T. Rowe Price Associates Inc. 7) Massachusetts Financial Services Co. 8) Norges Bank Investment Management 9) Capital World Investors 10) State Street Corp. These institutional investors and funds play a major role in influencing the decisions and direction of the company as they hold significant stakes in Lululemon Athletica Inc.

Lululemon Mission Statement

Lululemon’s mission statement is to elevate the world from mediocrity to greatness. They aim to provide innovative and high-quality athletic wear that inspires people to live their best, most fulfilling lives. They are dedicated to creating a community of active individuals who strive for personal growth, health, and happiness. Lululemon is committed to making a positive impact on the world and empowering people to reach their full potential.

How Lululemon Makes Money?

Lululemon operates as a yoga-inspired athletic apparel retailer and manufacturer. The company makes money primarily through the sale of its high-quality and fashionable athletic wear, including leggings, sports bras, and outerwear. Additionally, Lululemon offers athletic accessories, footwear, and its line of men’s athletic wear. The company also generates revenue through its online sales and its global network of brick-and-mortar stores. Lululemon’s revenue stream is also fueled by its successful loyalty program and partnerships with fitness influencers and athletes to promote their products. Overall, the company’s business model focuses on providing premium athletic apparel and fostering a strong community of loyal customers.

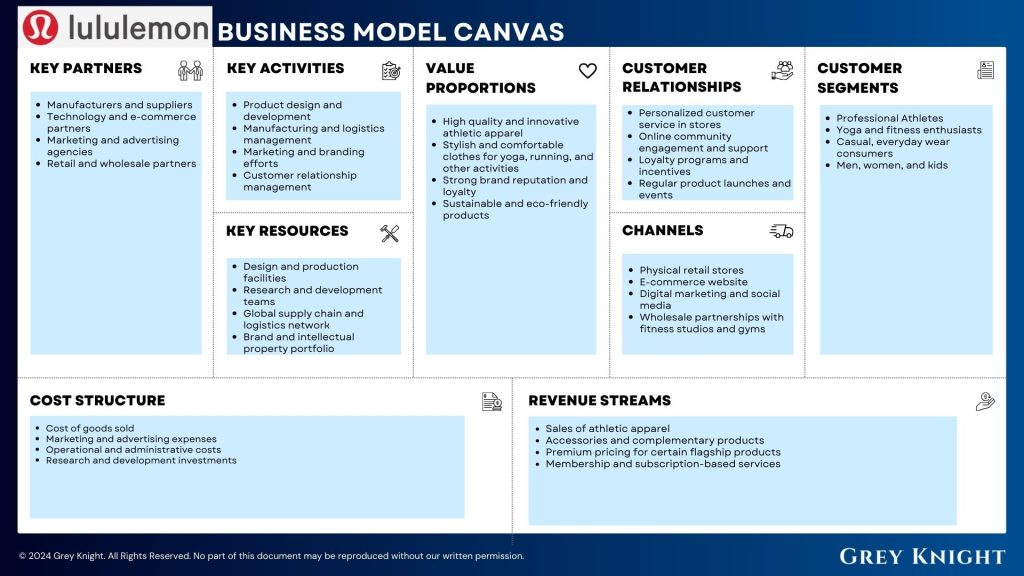

Lululemon Business Model Canvas

The Business Model Canvas is a strategic management tool that provides a visual representation of a company’s business model. It consists of nine key elements that help businesses to understand, design, and articulate their business model in a structured way. These elements include Customer Segments, Value Propositions, Channels, Customer Relationships, Revenue Streams, Key Resources, Key Activities, Key Partners, and Cost Structure. In this Business Model Canvas, we will analyze the strategic approach of Lululemon Athletica Inc., a well-known athletic apparel company.

Customer Segments:

1. Professional Athletes

2. Yoga and fitness enthusiasts

3. Casual, everyday wear consumers

4. Men, women, and kids

Value Propositions:

1. High quality and innovative athletic apparel

2. Stylish and comfortable clothes for yoga, running, and other activities

3. Strong brand reputation and loyalty

4. Sustainable and eco-friendly products

Channels:

1. Physical retail stores

2. E-commerce website

3. Digital marketing and social media

4. Wholesale partnerships with fitness studios and gyms

Customer Relationships:

1. Personalized customer service in stores

2. Online community engagement and support

3. Loyalty programs and incentives

4. Regular product launches and events

Revenue Streams:

1. Sales of athletic apparel

2. Accessories and complementary products

3. Premium pricing for certain flagship products

4. Membership and subscription-based services

Key Resources:

1. Design and production facilities

2. Research and development teams

3. Global supply chain and logistics network

4. Brand and intellectual property portfolio

Key Activities:

1. Product design and development

2. Manufacturing and logistics management

3. Marketing and branding efforts

4. Customer relationship management

Key Partners:

1. Manufacturers and suppliers

2. Technology and e-commerce partners

3. Marketing and advertising agencies

4. Retail and wholesale partners

Cost Structure:

1. Cost of goods sold

2. Marketing and advertising expenses

3. Operational and administrative costs

4. Research and development investments

By analyzing the Business Model Canvas of Lululemon Athletica Inc., it is evident that the company has positioned itself as a premium brand offering high-quality athletic apparel for a diverse customer base. Their strong focus on innovation, sustainability, and customer relationships has contributed to their success in the active lifestyle market.

Lululemon’s Competitors

Lululemon Athletica Inc. is a leading athletic apparel company that specializes in yoga-inspired clothing and accessories. The company has a number of competitors in the athletic apparel industry, including Nike, Under Armour, Adidas, Athleta, and Fabletics. These competitors offer a wide range of athletic wear and accessories, and have a significant presence in the market for performance wear and leisure wear. Lululemon Athletica Inc. faces tough competition from these companies, but continues to maintain a strong presence in the industry with its high-quality products and focus on innovation.

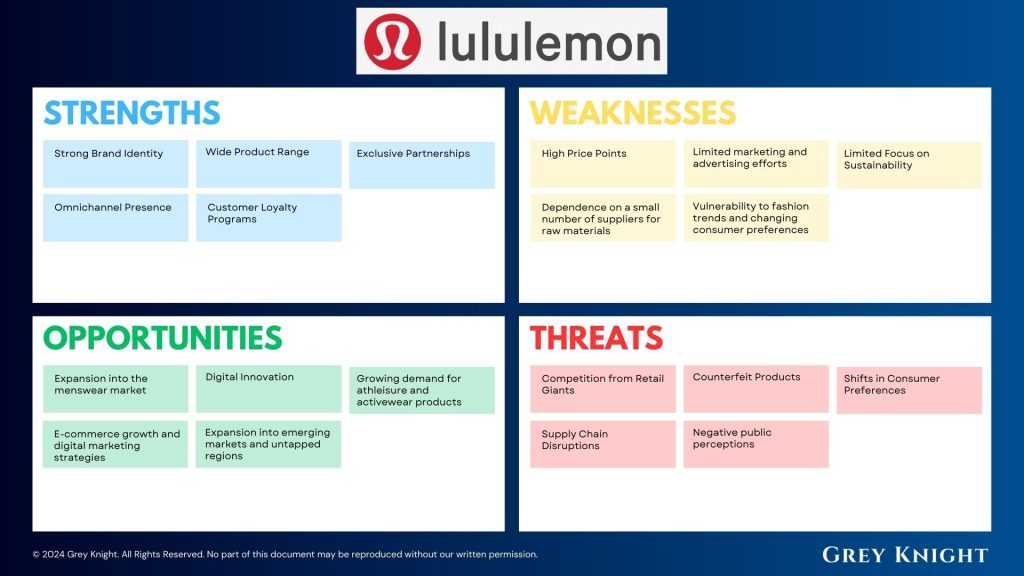

Lululemon SWOT Analysis

Strengths:

1. Strong brand recognition and loyal customer base

2. Innovative product designs and technical fabrics

3. Diversified product line with apparel, accessories, and footwear

4. Growing international presence and expansion into new markets

Weaknesses:

1. High product pricing compared to competitors

2. Limited marketing and advertising efforts

3. Dependence on a small number of suppliers for raw materials

4. Vulnerability to fashion trends and changing consumer preferences

Opportunities:

1. Expansion into the menswear market

2. Growing demand for athleisure and activewear products

3. E-commerce growth and digital marketing strategies

4. Expansion into emerging markets and untapped regions

Threats:

1. Intense competition from other athletic apparel brands and activewear retailers

2. Fluctuating raw material costs and supply chain disruptions

3. Economic downturns and consumer spending shifts

4. Negative public perceptions and potential brand image damage.

Concluding Analysis

In my perspective as an analyst, the future of Lululemon looks promising. With a successful business model that focuses on high-quality products, strong brand loyalty, and a growing international presence, the company is well-positioned for continued success in the athletic apparel industry. Additionally, the company’s adaptability and innovation in response to changing consumer trends and preferences bode well for its future growth and profitability. As the demand for athleisure and activewear continues to rise, Lululemon’s strong financial performance and strategic initiatives make it a solid contender for long-term investment. Overall, Lululemon’s business model demonstrates resilience and potential for continued success in the years to come.

Additional Resources

To keep learning and advancing your career, we highly recommend these additional resources:

Business Model Canvas of The Top 1,000 Largest Companies by Market Cap in 2024

A List of 1000 Venture Capital Firms & Investors with LinkedIn Profiles

Peter Thiel and the 16 Unicorns: The Legacy of Thiel Fellowship