Table of Contents

ToggleA Brief History of ICICI Bank

ICICI Bank Limited, originally known as Industrial Credit and Investment Corporation of India, was established in 1955 as a joint initiative of the World Bank, the Government of India, and representatives of Indian industry. It was set up with the objective of providing medium-term and long-term project financing to Indian businesses.

Over the years, ICICI Bank expanded its services and became one of India’s leading financial institutions, providing a wide range of banking and financial products to customers across the country. In 2002, the bank merged with two of its subsidiaries, ICICI Personal Financial Services Limited and ICICI Capital Services Limited, to form ICICI Bank Limited.

Since its inception, ICICI Bank has grown both organically and through strategic acquisitions, becoming one of the largest and most trusted banks in India. The bank has also expanded its operations internationally, with a presence in several other countries.

Today, ICICI Bank offers a wide range of financial products and services, including retail banking, corporate banking, wealth management, and insurance. It has also embraced digital banking and technology, providing customers with innovative and convenient banking solutions.

Who Owns ICICI Bank?

Overall, ICICI Bank Limited has a rich history of growth and success, and it continues to be a prominent player in the Indian banking industry.

ICICI Bank Limited is owned by a combination of institutional and retail investors, with the majority of the ownership held by institutional investors. The top 10 shareholders of ICICI Bank Limited as of the latest available data include:

1. Government of Singapore

2. Housing Development Finance Corporation Ltd

3. Life Insurance Corporation of India

4. The Bank of New York Mellon

5. Vanguard Group, Inc.

6. State Street Corporation

7. BlackRock, Inc.

8. ICICI Bank Limited

9. OppenheimerFunds, Inc.

10. SBI Funds Management Pvt Ltd

These shareholders hold a significant stake in the bank and have a substantial influence on its governance and strategic decisions. As a publicly traded company, ICICI Bank Limited’s ownership is constantly changing as investors buy and sell shares in the company.

ICICI Bank Mission Statement

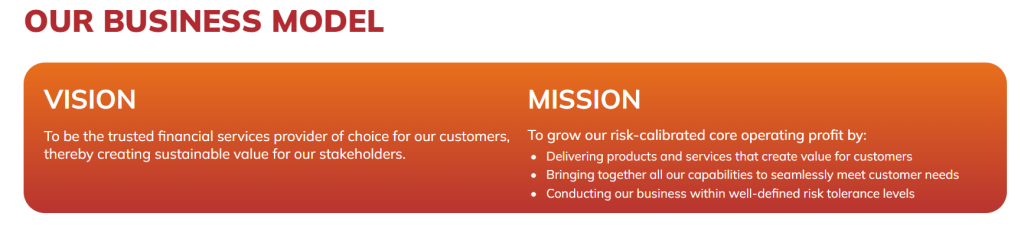

ICICI Bank Limited’s mission statement is to be the leader in the financial industry, providing innovative and world-class banking and financial services to their customers. They aim to create value for their stakeholders and contribute to the economic growth and development of the country. Their mission is to constantly strive for excellence and deliver the highest levels of customer satisfaction, while also being a responsible corporate citizen and contributing to the overall well-being of society. They are committed to achieving their goals with integrity, professionalism, and a strong focus on ethical practices.

How ICICI Bank Makes Money?

ICICI Bank Limited operates under a universal banking model, offering a wide range of financial products and services including retail and corporate banking, wealth management, and insurance. The bank makes money primarily through interest income on loans and advances, fees and commissions from various banking services, and investment and trading activities. Additionally, ICICI Bank generates revenue from its subsidiaries and associates in the areas of insurance, asset management, and investment banking. The bank’s diverse revenue streams contribute to its overall profitability and sustainability in the highly competitive Indian banking sector.

ICICI Bank Business Model Canvas

The Business Model Canvas is a strategic management tool that provides a visual representation of a company’s business model. It consists of nine key elements that help in understanding the organization’s value proposition, target customer segments, key activities, resources, and cost structure, among other important aspects. This tool is used to help businesses identify opportunities for innovation, growth, and sustainability. In this analysis, we will explore the business model canvas of ICICI Bank Limited, one of India’s largest private sector banks.

Customer Segments:

1. Retail Banking Customers: Individuals and families who require banking services such as savings accounts, personal loans, and credit cards.

2. Corporate Banking Customers: Businesses and organizations in need of financial products and services such as corporate loans and treasury management.

3. Wealth Management Clients: High-net-worth individuals seeking investment and wealth management services.

4. NRI Customers: Non-resident Indians looking for banking solutions tailored to their specific needs.

Value Propositions:

1. Financial Services: ICICI Bank offers a wide range of financial products and services, including banking, lending, insurance, and wealth management.

2. Convenience: The bank provides multiple channels for accessing its services, including branches, ATMs, online banking, and mobile apps.

3. Innovation: ICICI Bank invests in technology and digital solutions to enhance customer experience and offer innovative banking solutions.

4. Trust and Security: The bank prioritizes the security and privacy of its customers’ financial data and transactions.

Channels:

1. Branch Network: ICICI Bank has a vast network of branches across India and in select international locations.

2. ATMs: The bank’s ATMs provide convenient access to cash withdrawals, deposits, and other basic banking services.

3. Online and Mobile Banking: Customers can access their accounts and conduct transactions through the bank’s website and mobile app.

4. Phone Banking: ICICI Bank offers customer service and support through phone banking channels.

Customer Relationships:

1. Personalized Service: The bank aims to build and maintain strong relationships with its customers by addressing their individual needs and preferences.

2. Digital Engagement: ICICI Bank leverages digital channels to engage with customers and provide them with a seamless and convenient banking experience.

3. Customer Support: The bank offers customer support through various channels, including in-person assistance at branches and online assistance through chat and email.

Revenue Streams:

1. Interest and Fees: ICICI Bank generates revenue from the interest earned on loans and credit products, as well as from service fees and charges.

2. Investment and Wealth Management: The bank earns fees and commissions from providing investment and wealth management services to clients.

3. Insurance: Revenue is generated through the sale of insurance products such as life and health insurance.

Key Resources:

1. Human Capital: Skilled employees with expertise in banking, finance, technology, and customer service.

2. Technology Infrastructure: IT systems and digital platforms that support the bank’s operations and customer-facing services.

3. Brand and Reputation: ICICI Bank’s strong brand and reputation are valuable resources that contribute to its success and customer trust.

Key Activities:

1. Lending and Credit: The bank’s core activity involves providing loans and credit facilities to individual and corporate customers.

2. Risk Management: ICICI Bank engages in activities related to risk assessment, mitigation, and compliance to ensure the safety and soundness of its operations.

3. Digital Transformation: The bank continuously invests in upgrading its technology infrastructure and digital capabilities to adapt to changing customer preferences and market trends.

Key Partners:

1. Financial Institutions: Collaborations with other banks and financial institutions for interbank transactions and international banking services.

2. Technology Providers: Partnerships with technology companies to leverage digital solutions and innovative platforms for banking services.

3. Insurance Companies: Strategic alliances with insurance providers for offering a range of insurance products to customers.

Cost Structure:

1. Employee Salaries and Benefits: The bank incurs costs related to employee compensation, training, and benefits.

2. Technology Investments: Costs associated with developing and maintaining IT systems, digital platforms, and cybersecurity measures.

3. Marketing and Promotion: Expenses related to marketing activities, branding, and promotion of the bank’s products and services.

ICICI Bank’s Competitors

ICICI Bank Limited faces strong competition in the banking and financial services industry. Some of its top competitors include HDFC Bank, State Bank of India, Axis Bank, Kotak Mahindra Bank, and Punjab National Bank. These competitors offer a range of banking and financial products and services, and compete with ICICI Bank for market share and customer loyalty. With a strong presence in the Indian market, ICICI Bank continues to face tough competition from these key players in the industry.

ICICI Bank SWOT Analysis

Strengths:

– Strong presence and brand equity in the Indian banking market

– Diverse range of financial products and services

– Robust technological infrastructure

– Strong customer base and network of branches and ATMs

Weaknesses:

– Exposure to risk in a volatile economic and regulatory environment

– Dependence on third-party distributors for product sales

– Limited presence in international markets

– High levels of non-performing assets

Opportunities:

– Expansion into untapped rural and semi-urban markets

– Growth potential in digital banking and fintech

– Increasing demand for retail and corporate banking services

– Strategic partnerships and alliances with global financial institutions

Threats:

– Intense competition from other banks and financial institutions

– Fluctuations in interest rates and currency exchange rates

– Regulatory changes and compliance requirements

– Economic downturns and market volatility.

Concluding Analysis

In summary, ICICI Bank Limited has demonstrated a robust and adaptable business model that has propelled it to become one of the leading financial institutions in India. Their emphasis on digital innovation, diversification of services, and customer-centric approach has undeniably set them apart in the industry. As an analyst, my perspective on the future of ICICI Bank is optimistic. With their strong foundation and willingness to evolve, I foresee continued success and growth for the bank. Their proactive stance on embracing new technologies and their ability to navigate through economic fluctuations positions them well for sustained profitability and competitiveness in the years to come. Overall, ICICI Bank’s dynamic business model is certainly a force to be reckoned with in the ever-changing landscape of banking.

Additional Resources

To keep learning and advancing your career, we highly recommend these additional resources:

Business Model Canvas of The Top 1,000 Largest Companies by Market Cap in 2024

A List of 1000 Venture Capital Firms & Investors with LinkedIn Profiles

Peter Thiel and the 16 Unicorns: The Legacy of Thiel Fellowship