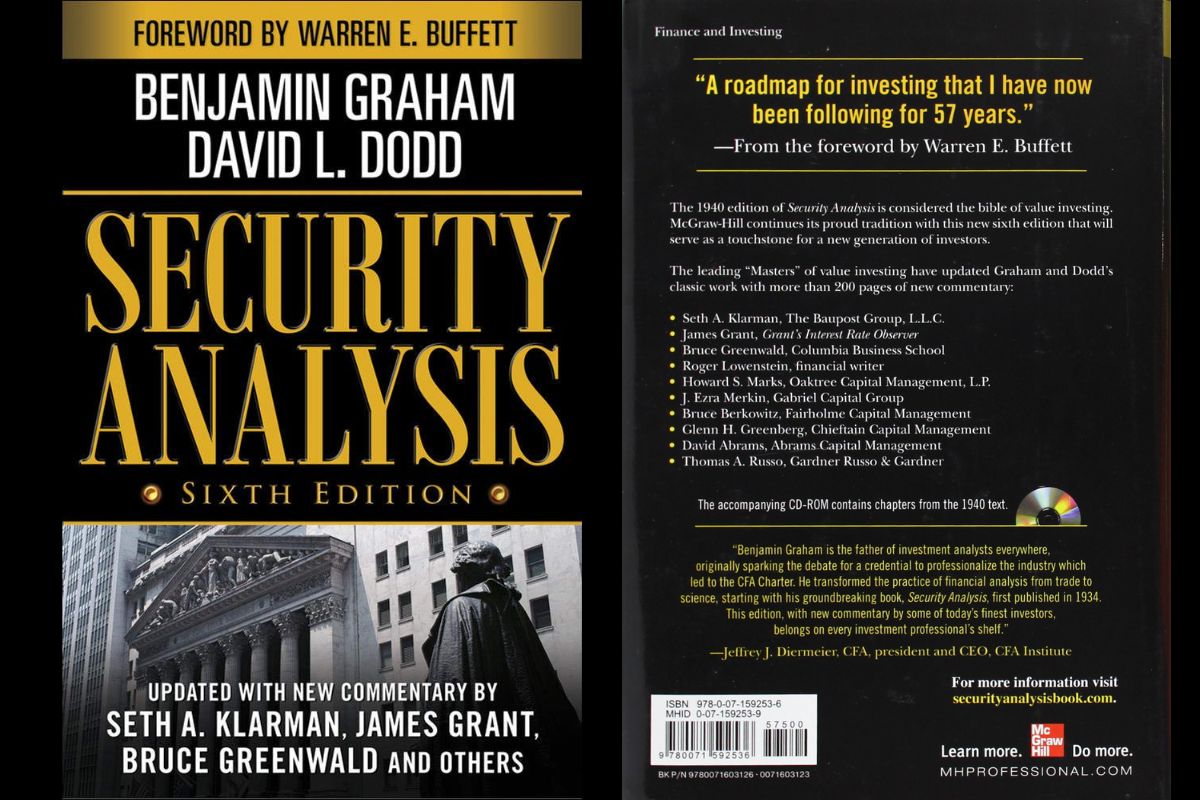

“Security Analysis” by Benjamin Graham is considered a classic book on investing that has stood the test of time. Originally published in 1934, the book is now in its seventh edition, and its principles and techniques are still relevant today. In this summary, we will explore the key ideas and concepts presented in the book.

Table of Contents

ToggleIntroduction

The book begins by introducing the concept of value investing, which is based on the idea that the market is not always rational and that the price of a stock can deviate from its intrinsic value. Graham explains that value investing involves analyzing the financial statements of a company to determine its true worth and then buying the stock when it is undervalued.

Part One: Principles of Investment

Chapter One: The Scope and Limits of Security Analysis

In this chapter, Graham introduces the concept of security analysis and explains its scope and limitations. He argues that security analysis is the process of examining the financial statements of a company to determine its intrinsic value. He also points out that security analysis has its limitations because it is difficult to predict future events that can affect the value of a company.

Chapter Two: The Concept of Intrinsic Value

Graham defines intrinsic value as the true or inherent value of a company. He argues that the intrinsic value is not the same as the market price of the stock, which can be influenced by various factors such as speculation, hype, and panic. He also explains that the intrinsic value can be estimated by analyzing the financial statements of a company.

Chapter Three: The Theory of Common Stock Investment

In this chapter, Graham explains the theory of common stock investment. He argues that investing in common stocks is a way to participate in the growth of a company and that the value of a stock is based on the future earnings of the company. He also stresses the importance of diversification in investing and suggests that investors should hold a portfolio of stocks.

Chapter Four: The Selection of Common Stocks

Graham presents a framework for selecting common stocks. He suggests that investors should focus on companies with a solid financial position, consistent earnings, and a strong competitive position. He also argues that investors should buy stocks when they are undervalued and sell them when they are overvalued.

Part Two: Fixed-Value Investments

Chapter Five: The Scope and Limitations of Fixed-Value Investments

In this chapter, Graham introduces the concept of fixed-value investments and explains its scope and limitations. He argues that fixed-value investments, such as bonds and preferred stocks, offer a fixed return and are less risky than common stocks. However, he also points out that fixed-value investments have their limitations because they are subject to interest rate risk.

Chapter Six: The Forms of Fixed-Value Investments

Graham explains the different forms of fixed-value investments, including bonds, preferred stocks, and convertible securities. He suggests that investors should analyze the financial statements of a company before investing in its fixed-value securities.

Chapter Seven: The Analysis of Fixed-Value Investments

In this chapter, Graham presents a framework for analyzing fixed-value investments. He suggests that investors should focus on the creditworthiness of the issuer, the interest rate, and the term of the security. He also argues that investors should diversify their fixed-value investments.

Part Three: Analysis of the Income Account

Chapter Eight: Elements of the Income Account

Graham explains the elements of the income account, including sales, cost of goods sold, gross profit, and operating expenses. He suggests that investors should analyze the income statement of a company to determine its profitability.

Chapter Nine: The Income Account in Relation to Capital Accounts

In this chapter, Graham covers the analysis of a company’s income statement, which provides information on its revenues, expenses, and profits over a specific period. Graham suggests that investors should focus on key factors such as gross profit margin, operating profit margin, net profit margin, and earnings per share when analyzing the income statement, as these can provide insight into a company’s profitability and financial health. EPS, in particular, is a crucial measure used by investors to evaluate a company’s financial performance and potential for growth.

Part Four: Analysis of the Balance Sheet

Chapter Ten: Elements of the Balance Sheet

Graham explains the elements of the balance sheet, including assets, liabilities, and equity. He suggests that investors should analyze the balance sheet of a company to determine its financial position.

Chapter Eleven: Additional Balance Sheet Considerations

In this chapter, Graham presents additional considerations when analyzing a company’s balance sheet, such as working capital, depreciation, and reserves. He argues that investors should pay attention to these factors to determine the financial health of a company.

Chapter Twelve: Analysis of the Income Account and the Balance Sheet

Graham presents a framework for analyzing the income statement and balance sheet together. He suggests that investors should compare the income statement and balance sheet of a company over several years to determine its long-term financial health.

Part Five: The Valuation of Specific Securities

Chapter Thirteen: The Theory of Common Stock Valuation

In this chapter, Graham presents the theory of common stock valuation. He suggests that the value of a stock is based on its future earnings and that investors should estimate the future earnings of a company to determine its intrinsic value.

Chapter Fourteen: The Dividend Factor in Common Stock Valuation

Graham explains the importance of dividends in common stock valuation. He argues that a company’s ability to pay dividends is a sign of its financial strength and that investors should focus on companies with a history of paying dividends.

Chapter Fifteen: Stock Selection for the Defensive Investor

In this chapter, Graham presents a framework for stock selection for the defensive investor. He suggests that defensive investors should focus on large, established companies with a solid financial position and a history of paying dividends.

Chapter Sixteen: Stock Selection for the Enterprising Investor

Graham presents a different framework for stock selection for the enterprising investor. He suggests that enterprising investors should focus on smaller, undervalued companies with a strong competitive position and a potential for growth.

Part Six: The Analysis of Corporate Reports

Chapter Seventeen: The Significance of Financial Statement Analysis

Graham stresses the significance of financial statement analysis and argues that it is the most important tool for investors. He suggests that investors should analyze the financial statements of a company to determine its intrinsic value.

Chapter Eighteen: The Limitations of Financial Statement Analysis

In this chapter, Graham explains the limitations of financial statement analysis. He argues that financial statements cannot predict future events that can affect the value of a company, and that investors should be aware of these limitations.

Chapter Nineteen: The Quality of Financial Statements

Graham suggests that the quality of financial statements is important for investors. He argues that investors should look for companies that have a history of providing accurate and reliable financial statements.

Conclusion

“Security Analysis” by Benjamin Graham is a comprehensive book on investing that presents a framework for analyzing the financial statements of a company to determine its intrinsic value. The book emphasizes the importance of value investing, diversification, and long-term investing. While the book was originally published in 1934, its principles and techniques are still relevant today, making it a must-read for any serious investor.

Further Reading and Sources:

Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham

Berkshire Hathaway Letters to Shareholders 1965-2021

Additional Resources

To keep learning and advancing your career, we highly recommend these additional resources:

7 Financial Models Used by Investment Bankers