Table of Contents

ToggleIntroduction

The Chartered Financial Analyst (CFA) designation is a highly respected and recognized credential in the investment industry. The program, offered by the CFA Institute, is a rigorous, self-study program that covers a wide range of topics related to investment analysis and portfolio management.

Eligibility

To be eligible to take the CFA exam, candidates must have a bachelor’s degree or be in the final year of their undergraduate studies. In addition, candidates must have four years of professional work experience in the investment industry, or a combination of education and work experience totaling four years.

The CFA exam is offered twice per year, in June and December. Each level of the exam is a six-hour, computer-based test consisting of multiple-choice questions. Candidates must pass all three levels of the exam within a maximum of four years, to be awarded the CFA charter.

The CFA program is divided into three levels, with each level building upon the material covered in the previous level. Level I is considered the most basic level and covers the fundamentals of investment valuation and portfolio management. Level II focuses on the application of investment tools and analysis, while Level III focuses on portfolio management and strategy.

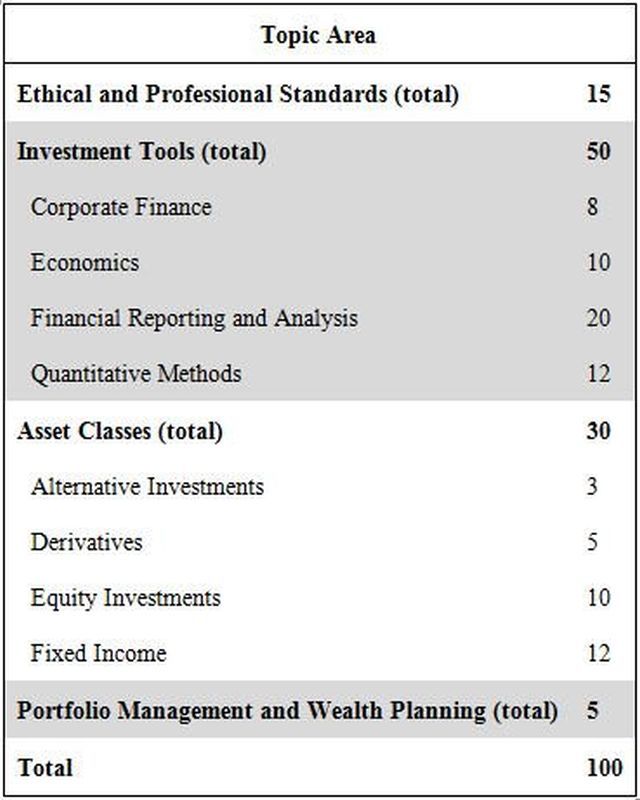

CFA Level I

This level is considered the most basic and covers the fundamentals of investment valuation and portfolio management. The exam consists of 240 multiple-choice questions and is divided into two three-hour sessions. The exam covers ethical and professional standards, quantitative methods, economics, and financial statement analysis.

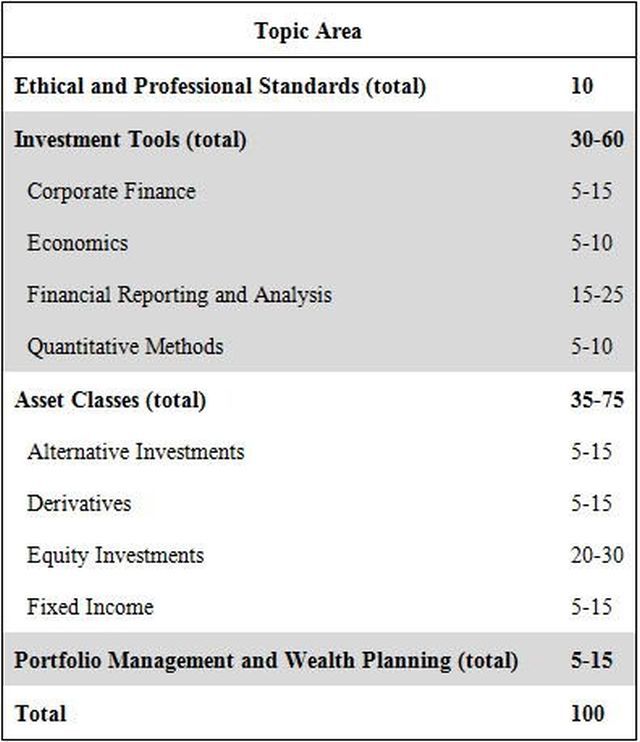

CFA Level II

This level focuses on the application of investment tools and analysis. The exam consists of 120 multiple-choice questions and is divided into two three-hour sessions. The exam covers portfolio management techniques, equity investments, and fixed income.

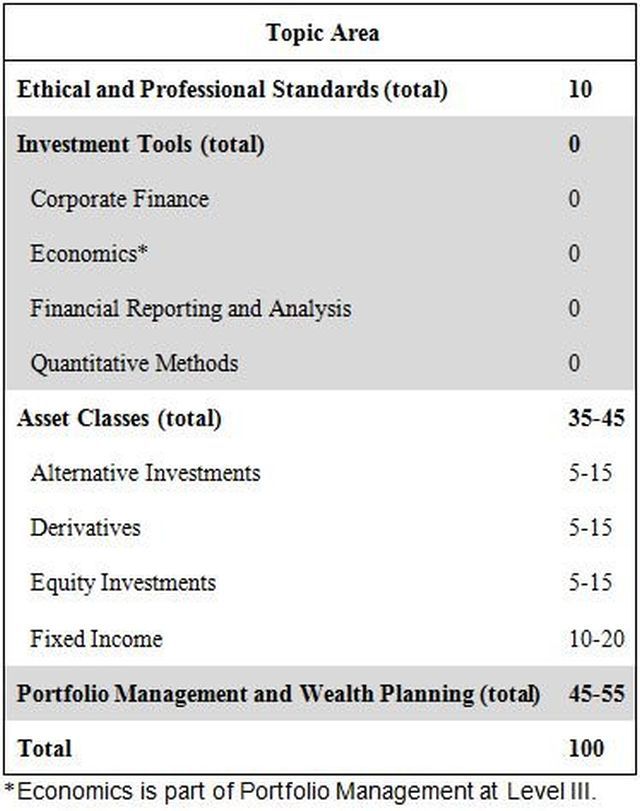

CFA Level III

This level focuses on portfolio management and strategy. The exam is divided into two parts: a morning session consisting of item set questions and an afternoon session consisting of constructed response questions. The exam covers alternative investments and portfolio management, as well as issues related to the application of the knowledge gained in the previous levels.

CFA Curriculum

The CFA curriculum is divided into ten study sessions, each covering a specific topic. The topics covered in the CFA program include ethical and professional standards, quantitative methods, economics, financial statement analysis, corporate finance, equity investments, fixed income, derivatives, alternative investments, and portfolio management.

The CFA curriculum is updated every year to ensure that it remains relevant and up-to-date with current industry practices and developments. The CFA Institute also publishes study materials, such as textbooks and practice exams, to help candidates prepare for the exam.

Passing the CFA exam is a significant accomplishment, and demonstrates a high level of knowledge and expertise in the investment industry. The CFA charter is widely recognized and respected by employers, clients, and peers in the industry.

The CFA charter also demonstrates a commitment to continuing education and professional development. CFA charterholders are required to adhere to a code of ethics and professional standards, and must complete continuing education requirements to maintain their charter.

The CFA program is a challenging and demanding program that requires a significant amount of time and effort to complete. However, the rewards for successfully completing the program are well worth the effort. The CFA charter is a valuable asset that can open doors to new career opportunities, and can lead to higher earning potential and greater job security.

Conclusion

In conclusion, the Chartered Financial Analyst (CFA) program is a highly respected and recognized credential in the investment industry. The program is a rigorous, self-study program that covers a wide range of topics related to investment analysis and portfolio management, including ethical and professional standards, quantitative methods, economics, financial statement analysis, corporate finance, equity investments, fixed income, derivatives, alternative investments, and portfolio management. The CFA charter is widely recognized and respected by employers, clients, and peers in the industry and demonstrates a commitment to continuing education and professional development. The CFA program is a challenging and demanding program, but the rewards for successfully completing the program are well worth the effort.

Additional Resources

To keep learning and advancing your career, we highly recommend these additional resources:

Venture Capital: A Comprehensive Overview

List of Fortune 500 Companies in 2023